At OnePath we understand that life insurance is a promise. We strive to honour that promise so as to make a real difference to the lives of our customers, and their loved ones during challenging circumstances.

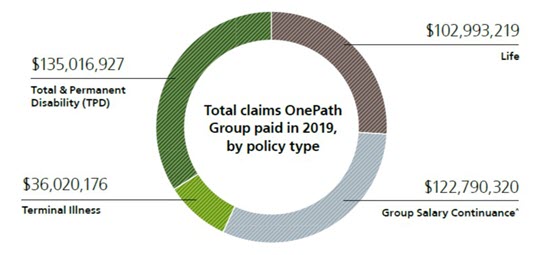

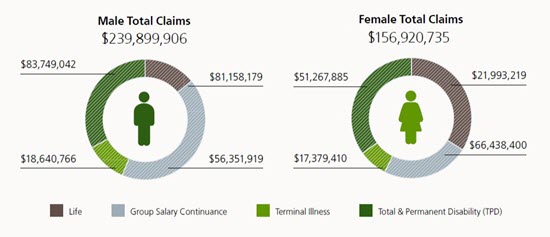

In 2019 OnePath paid more than $592 Million in life insurance claims to over 5,088 customers, which gives you the confidence that if things go wrong, we will be on your side.

Check out our latest claims brochure (PDF 3.3Mb) with information about the claims we paid.

- Trauma

- Total and Permanent Disability (TPD)

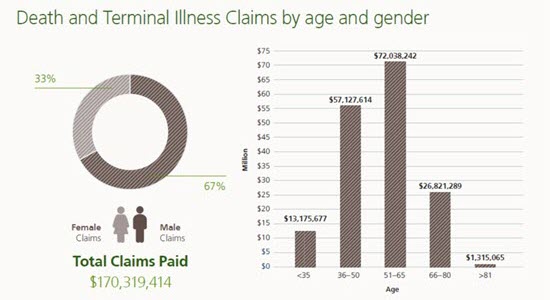

Provides a benefit on death which could be used to reduce debt, replace income of the deceased family member or pay for existing financial commitments like school fees. Terminal Illness provides a benefit on the diagnosis of a terminal illness which you could use to pay for medical expenses.

Paying claims is the business we are in, and the most important reason we exist.

Visit onepathclarity.com.au to find out more about our approach to claims - including real-life case studies that demonstrate why we make the decisions we do.

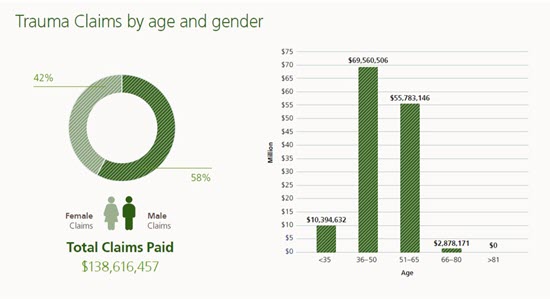

Provides a benefit for specific medical definitions in the event of serious illness or injury which you could use to help pay debt, and cover costs of lifestyle changes and out of pocket medical expenses.

I got diagnosed with breast cancer, stage one. Then surgery and I started radiation the beginning of October. I did 20 sessions of radiation, and a month after radiation I had to go on to the hormone blockers.

Two weeks after surgery we thought back that we might be able to claim with our insurance company with trauma. Greg (our financial adviser) found the best policy that suited us and our needs, OnePath was the best option for us and it has been for the last 12 years so that’s why we went through a adviser, because they did the work for us. Claims was easy, Greg came over and we filled out the paperwork [at home]… 3 weeks later the claim was sorted.

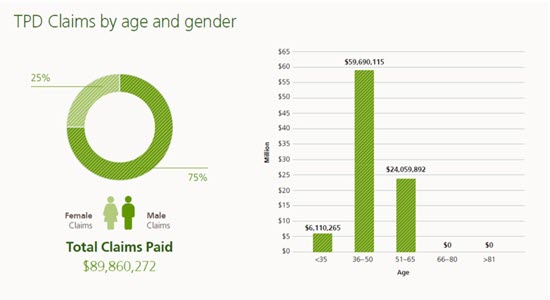

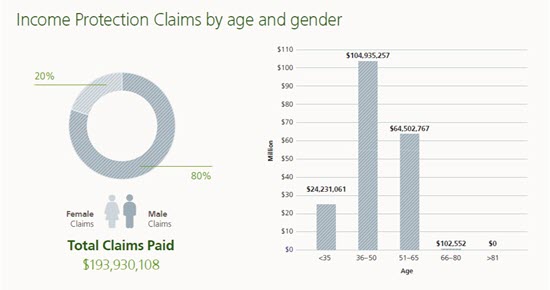

Provides financial support if an illness or injury stops you from returning to work or normal domestic duties.

“Just thought I’d update you, as I said I would, even though my claim finished back in January. A few weeks back I had trial surgery of a spinal cord stimulator… it worked tremendously week and have me around 70% pain relief. I’m scheduled to have a permanent implant this week.

Thank you so much for the way you handled me and my claim throughout its duration. You really made a testing time much easier with your caring and professional attitude. I can’t thank you enough for the understanding nature and manner.”

Anthony* – OnePath customer

Visit onepathclarity.com.au to find out more about our approach to claims - including real-life case studies that demonstrate why we make the decisions we do.

Replaces up to 80% of your monthly income if you cannot work because of illness or injury. You could use this to pay the bills and stay on top of day-to-day living expenses while you recover

Sally’s Income Protection Claim Story Sally fractured her arm in a cycling accident. While she only needed five days off work because of the injury, a conversation with her financial adviser led to Sally making a successful claim on her income protection policy. Read more about Sally’s claim story here.

In 2019 OnePath paid over $396 Million in claims to 6,342 members who have life insurance policies offered by employers and super funds which cover the employees members of the group.

In 2018 I was diagnosed with ovarian cancer, it was a big shock and I never saw that coming. I was just going for a routine check up with my gynaecologist, I saw him in October 2017 and by April 2018 I had Stage Four Ovarian Cancer.

I was lucky enough to realise that I had the income protection so that’s been fantastic, it’s been my saviour. If I didn’t have it I probably would have lost my house. If I wasn’t able to take time off work it would have compromised my treatment.